| Award Year |

Rank | Company | Service Overview |

|---|---|---|---|

| 2024 | 1st Place | Fivot |

|

| 2nd Place | Everimpact |

|

|

| 3rd Place | GeNiE |

|

|

| 2023 | 1st Place | Toggle G.K. |

|

| 2nd Place | Credit Engine, Inc. |

|

|

| 3rd Place | Inovat Ltd. |

|

|

| 2022 | 1st Place | KAERU, Inc. |

|

| 2nd Place | BetterData Pte. Ltd. |

|

|

| 3rd Place | Bee Informatica Sdn. Bhd. |

|

|

| 2021 | 1st Place | G-Bank technologies OÜ |

|

| 2nd Place | Caulis Inc. |

|

|

| 3rd Place | Tractable Ltd. |

|

|

| 2020 | 1st Place | Paygilant |

|

| 2nd Place | Credify Pte.Ltd |

|

|

| 3rd Place | CrowdLoan Inc. |

|

|

| 2019 | 1st Place | Frich, Inc. |

|

| 2nd Place | Fly Money Technologies LTD |

|

|

| 3rd Place | 400F Co., Ltd. |

|

|

| 2018 | 1st Place | justInCase, Inc. |

|

| 2nd Place | TORANOTEC, Ltd. |

|

|

| 3rd Place | GLORY LTD. |

|

Based on the opinions from Tokyo residents, the themes requiring resolutions as follows were selected.

| Category | Themes |

|---|---|

| Themes shared across all financial services |

|

| Deposits /Withdrawals |

|

| Payments /remittance |

|

| Asset Management |

|

| Insurance |

|

| Financing |

|

| DX /Infrastructure |

|

In the Financial Innovation Category, applicants were received from 136 financial institutions across 35countries and regions.

Overview of the Support Program

The Support Program, which were provided, includes preliminary seminars, mentoring programs, and business matching opportunities. Based on the support program, selected companies were asked to materialize their proposed services/products in preparation for the final screening session.

Winners overview

| Rank | Company | Service Overview |

|---|---|---|

| 1st Place | Fivot |

|

| 2nd Place | Everimpact |

|

| 3rd Place | GeNiE |

|

Based on the opinions from Tokyo residents, the themes requiring resolutions as follows were selected.

| Category | Themes |

|---|---|

| Themes shared across all financial services |

|

| Deposits /Withdrawals |

|

| Payments |

|

| Asset Management |

|

| Insurance |

|

| Financing |

|

| DX /Infrastructure |

|

In the Financial Innovation Category, applications were received from 117 financial institutions across 27 countries and regions.

Overview of the Support Program

The Support Program, which were provided, includes preliminary seminars, mentoring programs, and business matching opportunities. Based on the support program, selected companies were asked to materialize their proposed services/products in preparation for the final screening session.

Winners overview

| Rank | Company(HQ Location) | Need | Service Overview |

|---|---|---|---|

| 1st Place | Toggle G.K. (Japan) |

|

|

| 2nd Place | Credit Engine, Inc. (japan) |

|

|

| 3rd Place | Inovat Ltd. (England) |

|

|

Solution Video from Winners

Award Ceremony

Click here for more details and archive videos

Based on the opinions from Tokyo residents, the themes requiring resolutions as follows were selected.

| Themes | Opinions of residents and companies in Tokyo | |

|---|---|---|

| Deposits/Withdrawals | 1. Enhanced bank compatibility for ATM use and account management |

|

| 2. Enhanced convenience of online banking (cost, operation, management, etc.) |

|

|

| Payments | 3. Ability to use convenient cashless payment methods besides e-money |

|

| 4. Enhanced e-money compatibility, such as allowing money transfer between apps, as too many types of e-money makes difficult to use |

|

|

| 5. Solutions for limited availability of stores that accept cashless payments such as credit cards and e-money |

|

|

| 6. Payment methods with lower settlement fees |

|

|

| 7. Value-added payment methods, such as donating a portion of the payment amount |

|

|

| Asset Management | 8. Neutral advice on procedures and neutral advice on suitable products so that beginners can easily start asset management |

|

| 9. Services and products that make it easier to start asset management, such as investment from small amounts or with low fees |

|

|

| 10. New services that provide investment advice in accordance with lifestyle and future plans |

|

|

| Insurance | 11. Neutral advice on insurance products that are suitable for each customer |

|

| 12. Simpler procedures for insurance |

|

|

| 13. Easier way of understanding insurance coverage status, etc |

|

|

| 14. Services for insurance sharing |

|

|

| Financing | 15. Loan services that are more readily available, such as lower costs/shorter processing time, etc |

|

| 16. Neutral advice on loans suitable or each person |

|

|

| 17. Products that are not restricted by age, occupation, income, etc |

|

|

| 18. Various loan services that meet the needs of startups, etc |

|

|

| Others | 19. Services that promote data utilization |

|

| 20. Services enhancing security, such to preventing financial crimes (e.g., fraudulent use of credit cards and cashless payments, security of online transactions, etc.) |

|

|

| 21. Further acceleration of digital transformation in the financial industry |

|

|

| 22. Services that promote collaboration within the financial industry and with non-financial industries |

|

|

| 23. Service that can collectively manage financial assets, such as bank accounts, insurance, securities, inheritance, etc |

|

|

| 24. New financial services to prepare for “the 100-year life” |

|

|

| 25. Comprehensive financial services for times of economic distress in the event of an emergency |

|

|

| 26. Financial services for overseas financial transactions and overseas tourists, such as multi-currency and multi-language services |

|

|

| 27. Simpler procedures for ID verification for opening account and eKYC |

|

|

| 28. Tools and services to promote financial education on asset management, insurance, etc |

|

|

In the Financial Innovation Category, applications were received from 108 financial institutions across 26 countries and regions.

Overview of the Support Program

In preparation for the final screening session, selected companies were asked to materialize their proposed services/products. The Support Program, which were provided, includes preliminary seminars, mentoring programs, and business matching opportunities.

Winners overview

| Rank | Company(HQ Location) | Need | Service Overview |

|---|---|---|---|

| 1st Place | KAERU, Inc. (Japan) Service Implemented |

New financial services to prepare for “the 100-year life” |

|

| 2nd Place | BetterData Pte. Ltd. (Singapore) |

Services that promote data utilization |

|

| 3rd Place | Bee Informatica Sdn. Bhd. (Japan) |

Improved loan services (cut down of costs/time etc.) |

|

Solution Video from Winners

Award Ceremony

Click here for more details and archive videos

Based on the opinions from Tokyo residents, the themes requiring resolutions as follows were selected.

| Category | Theme |

|---|---|

| Deposits & Withdrawals |

|

| Payments |

|

| Asset Management |

|

| Insurance |

|

| Financing |

|

| Others (Financial Service in General) |

|

In the Financial Innovation Category, applications were received from 88 financial institutions across 25 countries and regions.

Overview of the Support Program

In preparation for the final screening session, selected companies were asked to materialize their proposed services/products. The Support Program, which were provided, includes preliminary seminars, mentoring programs, and business matching opportunities.

Winners overview

| Company | Theme / Outline of proposed solutions |

|---|---|

| 1st: G-Bank technologies OÜ (Estonia) Service Implemented |

【Others (Financial Service in General)】 Want a service that allows for the integrated management of one’s financial assets, including bank accounts, insurance, securities, inheritances, etc. —–

|

| 2nd: Caulis Inc. (Japan) |

【Others (Financial Service in General)】 Want services to prevent financial crimes by enhancing security, etc. —–

|

| 3rd: Tractable Ltd. (UK) Service Implemented |

【Insurance】 Simple and easy to understand insurance procedures are needed. —–

|

Solution Video from Winners

Award Ceremony

Based on the opinions from Tokyo residents, the themes needing resolutions decided for each category.

Deposits & Withdrawals

| Themes | |

|---|---|

| Bank Teller window | 1. Inconvenient that there are some procedures of opening an account, such as ID verification |

| Online Banking | 2. Difficult to manage different login IDs and passwords and verification method for multiple online bank accounts |

| 3. Hard to find services or functions when using online banking | |

| Fees | 4. Deposits and withdrawal fees remain high |

| Remittance/Transfer | 5. Want a simple and low-cost app for making transfers |

Payments

| Themes | |

|---|---|

| Electric payments | 6. Want other convenient cashless payment methods besides e-money |

| 7. Too many different types of e-money make it a hassle to use | |

| 8. The number of stores in Japan that accept credit cards, etc, is limited | |

| Security | 9. Security systems should be strengthened to prevent theft and unauthorized use of cards/smartphones |

| Usability | 10. Want to have a payment system platform utilizing transportation/ MaaS |

Asset Management

| Themes | |

|---|---|

| Investment Education | 11. Want tools for beginners for learning about finance |

| Procedure | 12. Want to start investing, but don’t understand how to start |

| Product Range | 13. Want advice on asset management products that is suitable for the respective customer from a neutral perspective |

| 14. There are few services/goods that can be managed with a smaller amount | |

| 15. Want a new service that allows investment advice to be received which is linked to daily life |

Insurance

| Themes | |

|---|---|

| Systems/Procedures | 16. Insurance procedures are inconvenient |

| 17. Difficult to find out status of insurance coverage | |

| Product Range | 18. Want advice on insurance products that is suitable for the respective customer from a neutral perspective |

| 19. Want a service that allows insurance sharing |

Financing

| Theme | |

|---|---|

| Procedures | 20. Want quicker and simpler procedures and examinations of loans |

| Product Range | 21. Want advice on loans that is neutral and suitable |

Others

| Theme | |

|---|---|

| 22. Want a service that can manage financial assets collectively, such as bank accounts, insurance, securities, inheritance etc. | |

| 23. Want to have a new financial service in preparation for the coming age in which life expectancy will average 100 years | |

| 24. Want to have a proactive service to prevent financial crime | |

| 25. Want to have comprehensive financial service in the event of an economic crisis |

BtoB

| Theme | |

|---|---|

| 26. Want a loan service that meets the unique needs of start-up companies and SMEs | |

| 27. To suit the new work style at With/After COVID19, want a service to enhance the security | |

| 28. Want a service to promote data utilization | |

| 29. Want to further accelerate digital transformation in the financial industry | |

| 30. Want a service that promotes collaboration within the financial industry and with non-financial industries |

In Financial Innovation category, applications were received from 90 financial institutions across 20 countries and regions.

Support program

As the selected companies head towards the final screening they worked on developing their proposed service or product into a concrete offering. The Support Program included preliminary seminars, a mentoring program, business matching opprtunities, and provision of office space.

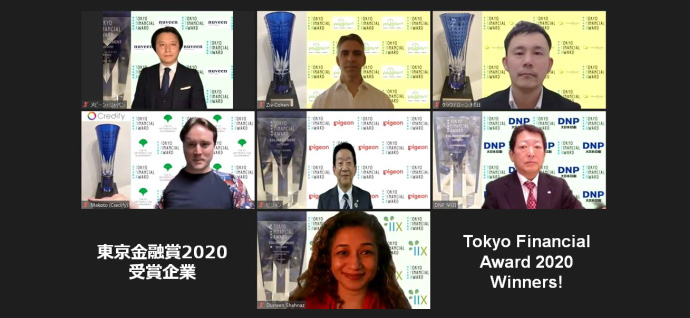

Winners overview

| Company | Theme / Summary of Solution |

|---|---|

| 1st: Paygilant | | BtoB | Want to further accelerate digital transformation in the financial industry ----- Providing fraud detection services that combine six additional types of information, including behavioral biometrics and transaction analysis technology |

| 2nd: Credify Pte.Ltd Service Implemented |

| BtoB | Want a service to promote data utilization ----- Provides "idX," a solution based on the concept of "self-sovereign ID" and "distributed ID," which allows users to manage their own personal information and control the scope of disclosure. |

| 3rd: CrowdLoan Inc. Service Implemented |

| BtoB | Want to further accelerate digital transformation in the financial industry ----- In addition to data on the loan performance of users using the company's services, a function has been added that uses external data to improve the screening system using proprietary AI. |

Solution Video from Winners

Award Ceremony

Based on the opinions from Tokyo residents, the themes needing resolutions decided for each category.

Deposits & Withdrawals

| Themes | |

|---|---|

| Bank teller window | 1. Inconvenient that there are some procedures which can only be done in bank branches, such as ID verification |

| Online Banking | 2. Difficult to manage different login IDs and passwords and verification method for multiple online bank accounts |

| 3. Hard to find services or functions when using online banking | |

| Fees | 4. Deposits and withdrawal fees remain high |

| Remittance/ Transfer |

5. Want a simple and low-cost app for making transfers |

Payments

| Themes | |

|---|---|

| Electric payments | 6. Want other convenient cashless payment methods besides e-money |

| 7. Too many different types of e-money makes it a hassle to use | |

| 8. The number of stores in Japan that accept credit cards, etc, is limited | |

| Security | 9. Security systems should be strengthened to prevent theft and unauthorized use of cards/smartphones |

| Usability | 10. Want to have a payment system platform utilizing transportation/ MaaS * |

Asset Management

| Themes | |

|---|---|

| Invest Education | 11. Want tools for beginners for learning about investment |

| Procedures | 12. Want to start investing, but don’t understand how to start |

| Product Range | 13. Want advice on asset management products that is suitable for the respective customer from a neutral perspective |

| 14. There are few services/goods that can be managed with a smaller amount | |

| 15. Want a new service that allows investment advice to be received which is linked to daily life |

Insurance

| Themes | |

|---|---|

| Systems/ Procedures | 16. Insurance procedures are inconvenient |

| 17. Difficult to find out status of insurance coverage | |

| Product Range | 18. Want advice on insurance products that is suitable for the respective customer from a neutral perspective |

| 19. Want a service that allows insurance sharing |

Financing

| Themes | |

|---|---|

| Procedures | 20. Want quicker and simpler procedures and examinations of loans |

| Product Range | 21. Want advice on loans that is neutral and suitable |

| 22. Want a loan service that can accept even start-up companies with low credit ratings | |

| 23. Want a loan service tailored to cash flow |

Other

| Themes | |

|---|---|

| Management | 24. Want a service that can manage financial assets collectively, such as bank accounts, insurance, securities, inheritance etc. |

| Other | 25. Want to have a new financial service in preparation for the coming age in which life expectancy will average 100 years |

In Financial Innovation category, applications were received from 80 financial institutions across 17 countries and regions (including Japan).

Support program

As the selected companies head towards the final screening they worked on developing their proposed service or product into a concrete offering. The Support Program included preliminary seminars, a mentoring program, business matching opprtunities, and provision of office space.

Winners overview

| Company | Theme / Summary of Solution |

|---|---|

| 1st: Frich,Inc. Service Implemented |

| Insurance | Want a service that allows insurance sharing. ----- Providing pet insurance services for a limited number of breeds of dogs through SNS community groups. |

| 2nd: Fly Money Technologies LTD | | Payments | Too many different types of e-money makes it a hassle to use. ----- Offer services that allow user to exchange money into local currency, receive cash at home or at the airport, and deposit money into local payment services with lower fees at the time of booking. |

| 3rd: 400F Co., Ltd. Service Implemented |

| Asset Management | Want advice on asset management products that is suitable for the respective customer from a neutral perspective. ----- A service for individuals that provides asset management advice in a more understandable, appropriate, and efficient manner based on a "financial health checkup”. Chatbots with AI machine learning are used to provide neutral and appropriate information to clients. |

Solution Video from Winners

Award Ceremony

Based on the opinions from Tokyo residents, the themes needing resolutions decided for each category.

Deposits & Withdrawals

| Themes | |

|---|---|

| Bank teller window | 1. Inconvenient that there are some procedures which can only be done in bank branches, such as ID verification |

| Online Banking | 2. Difficult to manage different login IDs and passwords and verification method for multiple online bank accounts |

| 3. Hard to find services or functions when using online banking | |

| Fees | 4. Deposits and withdrawal fees remain high |

Payments

| Themes | |

|---|---|

| Electric payments | 5. Want other convenient cashless payment methods besides e-money |

| 6. Too many different types of e-money makes it a hassle to use | |

| Credit Card | 7. The number of stores in Japan that accept credit cards, etc, is limited |

| Security | 8. Security systems should be strengthened to prevent theft and unauthorized use of cards/smartphones |

Asset Management

| Themes | |

|---|---|

| Invest Education | 9. Want tools for beginners for learning about investment |

| Product Range | 10. Want advice on asset management products that is suitable for the respective customer from a neutral perspective |

| 11. There are few services/goods that can be managed with a smaller amount | |

| Procedures | 12. Want to start investing, but don’t understand how to start |

Insurance

| Themes | |

|---|---|

| Product Range | 13. Want advice on insurance products that is suitable for the respective customer from a neutral perspective |

| Systems/ Procedures | 14. Insurance procedures are inconvenient |

| 15. Difficult to find out status of insurance coverage |

Financing

| Themes | |

|---|---|

| Procedures | 16. Want quicker and simpler procedures and examinations of loans |

| Product Range | 17. Want advice on loans that is neutral and suitable |

| 18. Want a loan service that can accept even start-up companies with low credit ratings | |

| 19. Want a loan service tailored to cash flow |

Other

| Themes | |

|---|---|

| Management | 20. Want a service that can manage financial assets collectively, such as bank accounts, insurance, securities, inheritance etc. |

In “Resolution of Tokyo Residents’ Needs” category*, applications were received from 55 financial institutions across 16 countries and regions (including Japan).

* Renamed to “Financial Innovation” Category from 2019.

Support program

As the selected companies head towards the final screening they worked on developing their proposed service or product into a concrete offering. The Support Program included preliminary seminars, a mentoring program, business matching opprtunities, and provision of office space.

Winners overview

| Company | Theme / Summary of Solution |

|---|---|

| 1st: justInCase, Inc. Service Implemented |

| Insurance | Insurance procedures are inconvenient. ----- Insurance claims are to be completed within 90 seconds via the app's chatbot. |

| 2nd: TORANOTEC, Ltd. | | Asset Management | There are few services/goods that can be managed with a smaller amount. ----- Newly launched "Real Change Investment," a service that allows users to invest simply by inserting change into a change box set up in Tokyo. |

| 3rd: GLORY LTD. | | Deposits and Withdrawals | Inconvenient that there are some procedures which can only be done in bank branches, such as ID verification. ----- Development of an online "identity authentication platform" that uses "face" and "voice" for identity verification, with the aim of practical and commercialization. |

Solution Video from Winners

Award Ceremony