| Award Year |

Company | Service Overview |

|---|---|---|

| 2024 | [Governor’s Special Prize for Green Finance*1] Binex |

|

| MOL PLUS |

|

|

| The Shoko Chukin Bank |

|

|

| VALT JAPAN |

|

|

| 2023 | [Governor’s Special Prize for Green Finance*1] Kayrros SAS |

|

| ANRI Inc. |

|

|

| Nature Innovation Group Inc. |

|

|

| TBM Co., Ltd. |

|

|

| 2022 | [Governor’s Special Prize for Green Finance*1] HAKKI AFRICA INC |

|

| OUI Inc |

|

|

| Sustainacraft, Inc |

|

|

| 2021 | [Governor’s Special Prize for Green Finance*1] Daiwa Asset Management |

|

| Nomura Holdings, Inc. |

|

|

| SBICAP Ventures Limited |

|

|

| 2020 | Dai Nippon Printing Co. |

|

| ImpactInvestment Exchange(IIX) |

|

|

| Nuveen Japan Co. |

|

|

| Pigeon Corporation |

|

|

| 2019 | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. |

* It is one who supports the issuance of green bonds through the establishment of a Green Bond framework and others.

|

| Shinsei Corporate Investment Limited |

* Investments aiming to achieve both economic and social returns

|

|

| S&P Dow Jones Indices LLC. |

|

|

| 2018 | Neuberger Berman East Asia LTD. |

|

| Robeco Japan Company LTD. |

|

|

| SOMPO Holdings, Inc. |

|

|

| Sumitomo Mitsui Trust Asset Management Co., Ltd. |

|

*1 The Governor’s Special Prize for Green Finance, a new award created in FY2021, will be awarded to a business from the ESG Investment Category that is particularly outstanding in its green finance initiatives.

| Proliferation and promotion of ESG investments |

|

|

|

|

|

|

|

Initiatives that leverage sustainable finance* to help achieve a sustainable society

* Sustainability linked loans, sustainability funds or other similar methods of fundraising

In “ESG Investment” Category, applications were received from 85 businesses across 20 countries and regions.

Winners overview

| Company(Location) | Service Overview |

| [Governor’s Special Prize for Green Finance*1] Binex |

|

| MOL PLUS |

|

| The Shoko Chukin Bank |

|

| VALT JAPAN |

|

| Proliferation and promotion of ESG investments |

|

|

|

|

|

|

|

17 goals set forth in “Transforming our world: the 2030 Agenda for Sustainable Development” adopted at the 70th United Nations General Assembly

Source: UN HP

In “ESG Investment” Category, applications were received from 93 businesses across 21 countries and regions.

Winners overview & Award Ceremony

| Company(Location) | Service Overview |

| [Governor’s Special Prize for Green Finance*1] Kayrros SAS (France) |

|

| ANRI Inc. (Japan) |

|

| Nature Innovation Group Inc. (Japan) |

|

| TBM Co., Ltd. (Japan) |

|

*1 The Governor’s Special Prize for Green Finance, a new award created in FY2021, will be awarded to a business from the ESG Investment Category that is particularly outstanding in its green finance initiatives.

Award Ceremony

Click here for more details and archive videos

|

|

|

|

|

|

17 goals set forth in “Transforming our world: the 2030 Agenda for Sustainable Development” adopted at the 70th United Nations General Assembly

Source: UN HP

In “ESG Investment” Category, applications were received from 75 businesses across 16 countries and regions.

Winners overview & Award Ceremony

| Company(Location) | Service Overview |

| [Governor’s Special Prize for Green Finance*1] HAKKI AFRICA INC (Japan) |

|

| OUI Inc (Japan) |

|

| sustainacraft, Inc (Japan) |

|

*1 The Governor’s Special Prize for Green Finance, a new award created in FY2021, will be awarded to a business from the ESG Investment Category that is particularly outstanding in its green finance initiatives.

Award Ceremony

Click here for more details and archive videos

|

|

|

|

|

|

17 goals set forth in “Transforming our world: the 2030 Agenda for Sustainable Development” adopted at the 70th United Nations General Assembly

Source: UN HP

In “ESG Investment” Category, applications were received from 50 businesses across 13 countries and regions.

Winners overview & Award Ceremony

| Company | Outline of initiatives |

| [Governor’s Special Prize for Green Finance*1] Daiwa Asset Management (Japan) |

|

| Nomura Holdings, Inc. (Japan) |

|

| SBICAP Ventures Limited (India) |

|

*1 The Governor’s Special Prize for Green Finance, a new award created in FY2021, will be awarded to a business from the ESG Investment Category that is particularly outstanding in its green finance initiatives.

Award Ceremony

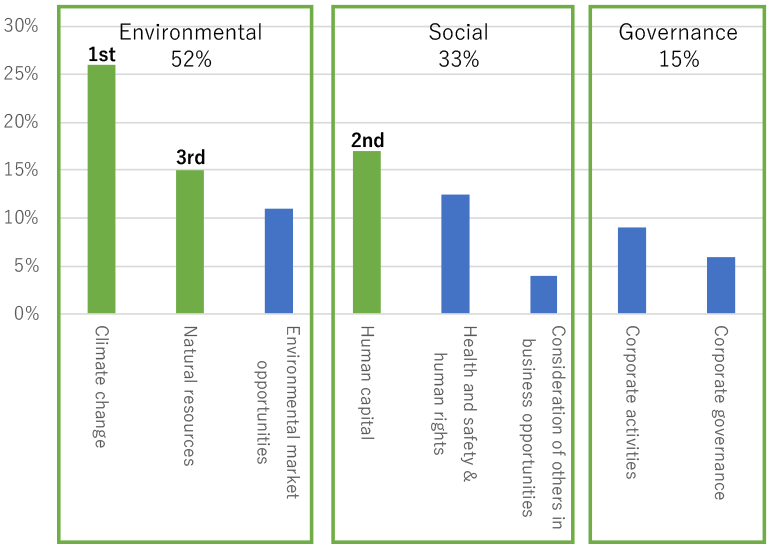

For each activity, select up to 3 themes from the 8 themes (E・S・G)below

|

|

|

|

|

|

We conducted hearing form experts and listed up the opinions about issues of ESG investment promotion.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each activity, select up to 3 from the 17 goals below.

Source: UN HP

We conducted hearing from experts and listed up the opinions about issues of SDGs management.

|

|

|

|

|

|

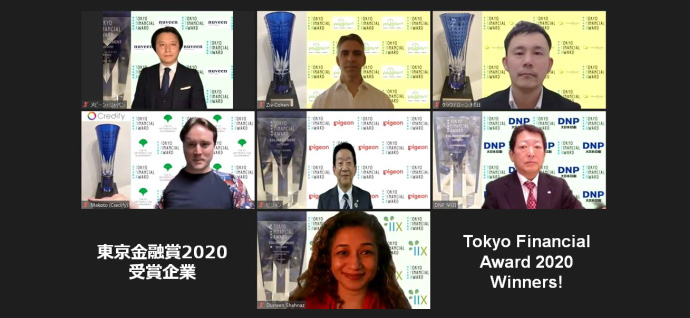

In “ESG Investment” category, applications were received from 66 institutions (104 activities) across 14 countries and regions.

Winners overview

| Company | Category | Main ESG investment promotion activity |

| Dai Nippon Printing Co. | SDGs Category | For the realization of a sustainable society, the company developed and promoted environmentally friendly packaging "GREEN PACKAGING” |

| ImpactInvestment Exchange(IIX) | ESG Investment Category | Issued social bonds that focused on promoting the social and economic advancement of women in Asia |

| Nuveen Japan Co. | ESG Investment Category | Improving the natural environment, etc. through investment in agricultural land around the world. Conducting activities to promote ESG and impact investing in Japan |

| Pigeon Corporation | SDGs Category | Supporting the spread of breast milk banks to save the lives of babies born small |

Award Ceremony

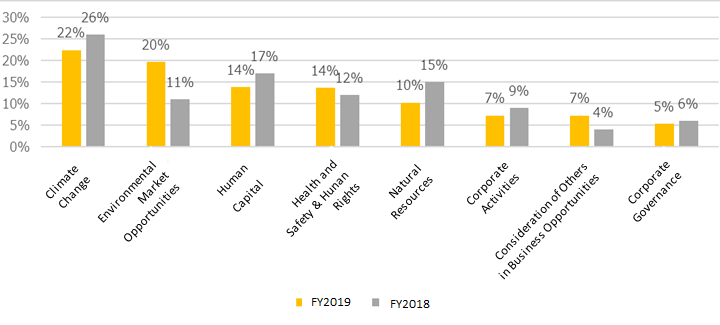

In the survey, we asked Tokyo Residents to share their thoughts on ESG investments. The questions consisted the choices of ESG investment examples from Environment, Social, Governance fields. Tokyo Residents selected the top three ESG investment examples that they care the most in their daily life and the top three selected are as follows:

1st: Climate Change

Global warming, CO2 emissions, Energy efficiency, Environmental pollution

2nd: Environmental Market Opportunities

Clean technology, Renewable energy

3rd: Human Capital

Labor management, Promotion of women’s participation, Diversity, Development of human resources

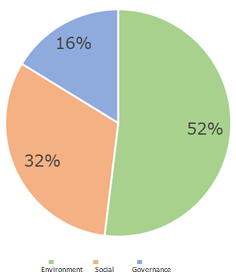

The question “Assuming that you are an investor, which area (environment, society or governance) do you want to invest in?” found that environment was the top concern followed by social and governance in the same order as social issues.

In “ESG Investment” category, applications were received from 38 financial institutions across 8 countries and regions (including Japan).

Winners overview

| Company | Main ESG investment promotion activity |

| Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. |

Contributing to ESG bond promotion in the domestic market ・ In the green bond market, the company gained the largest market share of more than 25% as well as the largest number of Green Bond Structuring Agent* in the country. ・ The company contributed to the market development from the founding period of the domestic ESG bond market as a pioneer. * It is one who supports the issuance of green bonds through the establishment of a Green Bond framework and others. |

| Shinsei Corporate Investment Limited |

Implementation of impact investments through the establishment of childcare and nursing care support funds ・ The company established the impact investment* fund which is the first-in-kind for Japanese bank groups as a solution to social challenges. ・ Focusing on social challenges that Tokyo residents are familiar and sympathize, the company aims to achieve both economic returns and social returns through the fund. * Investments aiming to achieve both economic and social returns |

| S&P Dow Jones Indices LLC. |

Development of “Index for reducing greenhouse gases” ・ GPIF adopted the index of Japanese and foreign stocks for reducing greenhouse gases as an environmental stock index, and started managing funds on a scale of approximately 1.2 trillion yen. ・ The company encouraged portfolio companies to improve carbon efficiency and to raise awareness of environmental issues through engagement and other measures. |

Award Ceremony

In the survey, we asked Tokyo Residents to share their thoughts on ESG investments. The questions consisted the choices of ESG investment examples from Environment, Social, Governance fields. Tokyo Residents selected the top three ESG investment examples that they care the most in their daily life and the top three selected are as follows:

1st: Climate Change

Example: Global warming, Extreme weather, Sustainable environment, CO2 emissions

2nd: Human Capital

Example: Labor management, Promotion of women’s participation, Diversity, Development of human resources

3rd Natural Resources

Example: Destruction of nature, Water resources, Land use, Biodiversity, Recycling

In “ESG Investment” category, applications were received from 40 financial institutions across 10 countries and regions (including Japan).

Winners overview

| Company | Main ESG investment promotion activity |

| Neuberger Berman East Asia LTD. |

|

| Robeco Japan Company LTD. |

|

| SOMPO Holdings, Inc. |

|

| Sumitomo Mitsui Trust Asset Management Co., Ltd. |

|

Award Ceremony