Following a rigorous review process, the winners of the Tokyo Financial Award 2025 – Sustainability Category – have been selected as follows!

| Subcategory | Company/ organization name |

Outline of initiatives |

|---|---|---|

| Investment/Business | Jikantechno (Governor’s Special Prize for Green Finance※) |

Manufactures silica and carbon materials using alternative materials such as rice husks that do not require chemical processing, through methods with low environmental impact. Through collaboration with agricultural sites, it further promotes decarbonization. |

| Investment/Business | GOYOH |

Provides real estate owners with EaSyGo, a system that visualizes, analyzes, and operationalizes sustainability value for properties. By analyzing social and economic indicators, experiential value, and utility usage, GOYOH visualizes social impact and also offers AI-driven recommendations for improvement. |

| Investment/Business | Tokyu Fudosan Holdings |

Issues an ESG bond, the “Greater Shibuya Area Biodiversity Green Bonds”. A portion of the proceeds is used to implement greening projects and biodiversity conservation initiatives in the Greater Shibuya area, where the company conducts urban development. |

| Sustainable Finance Human Resources Development |

Graduate School of Frontier Sciences, The University of Tokyo |

Provides approximately three months of lectures on sustainable finance for working professionals with over 10 years of work experience to develop specialized knowledge. After completion, study sessions and similar events are held to encourage continuous knowledge updates. |

| Sustainable Finance Human Resources Development |

Yumiko Miwa Seminar, School of Commerce, Meiji University (Judge’s Special Award※) |

Establish a network for undergraduate and graduate students to research environmental issues and social challenges beyond the confines of individual departments or universities. Through collaborative activities with society, such as partnerships with external companies, students will gain awareness of social issues and acquire specialized knowledge. |

* The Governor’s Special Prize for Green Finance recognizes outstanding performance in the field of green finance and is awarded to one business operator among the award-winning business operators.

* The Judge’s Special Award is presented by the judging committee to business operators in addition to the standard award recipients.

At the Tokyo Financial Award 2025 ceremony, held in collaboration with “Japan Fintech Week 2026” hosted by the Financial Services Agency on Monday, March 2, awards will be presented to the winning companies, followed by presentations by the award recipients.

Click here for the Tokyo Metropolitan Government press release.

Click here for details of the award ceremony and registration information.

Sustainable Finance

Have you heard of “Sustainable Finance” before?

Sustainable finance is a framework for utilizing funds for the purpose of transitioning to a more sustainable society, by addressing environmental issues such as climate change, social issues such as human rights and poverty, and other widespread common global issues.

The public’s approach to sustainable finance tends to focus on the environmental element which is of more interest and where companies have detailed pre-existing initiatives, and the social element, which addresses human rights and diversity issues. However, governance, which enables the healthy operation of companies, is another important element in driving forward sustainable finance.

One of the most notable aspects of Sustainable Finance in recent years has been the expansion of "green finance," which is financing to improve energy efficiency, reduce waste emissions, and introduce renewable energies.

Overview of the Sustainability Category

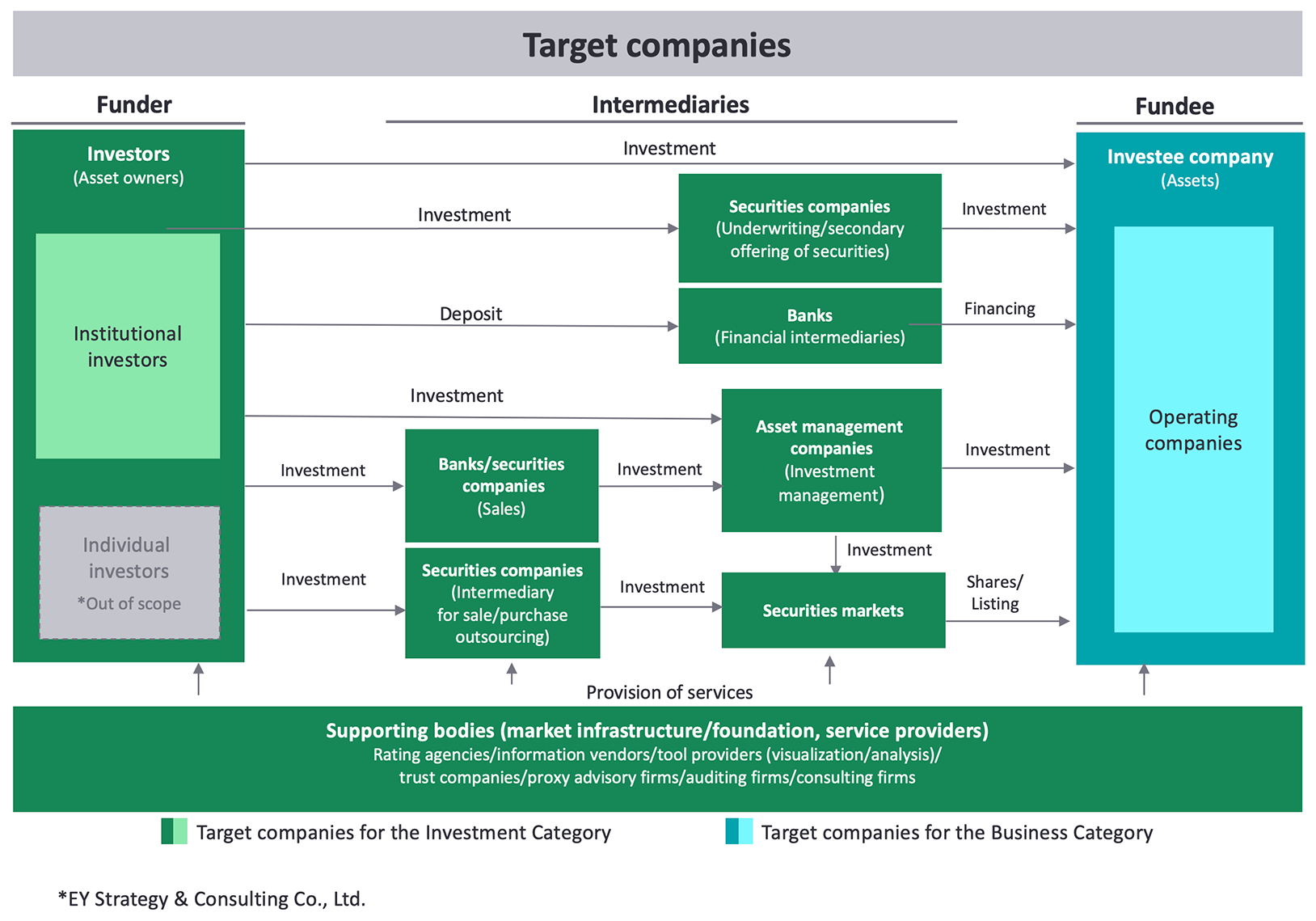

In the “Sustainability Category”, “Investment Subcategory” invites companies that engage in a wide range of financial activities including, but not limited to investment, lending, etc., that contribute to the realization of a sustainable society; and the “Business Subcategory” invites initiatives that utilize sustainable finance(including a wide range of financing method such as VC investments, etc.) that contributes to the realization of a sustainable society.

The “Sustainable Finance Human Resource Development Subcategory” invites applications for initiatives to increase the number of human resources and improve their skills in finance (lending, investment, insurance, etc.), related activities (provision of data and tools, sales brokerage, etc.), and fundraising (in the context of finance) and information disclosure at the “recipients” of funds, in order to realize a sustainable society along with the efforts to promote indirectly promote such initiatives (through the formulation of human resource development guidelines, environmental improvements, etc.) Initiatives may include those of your own company/organization, as well as those that provide services to others (whether paid or unpaid).

The Governor's Special Award will be presented to a business that is particularly outstanding in its green finance initiatives from among the applicants (about three institutions) selected as the most excellent businesses.

In addition to the award for the top three winners, “Special Award” may be given for outstanding initiatives.

Submission of applications

First-stage screening

Final screening

Award Ceremony

Thank you for submitting your solutions to the “Sustainability Category”.

The Applications are now closed.

Please contact the Secretariat at tfa@jp.ey.com for any questions

The Tokyo Financial Award's “Sustainability Category” is divided into three subcategories: the “Investment Subcategory,” the “Business Subcategory,” and the “Sustainable Finance Human Resource Development Subcategory.”

The “Investment Subcategory” is open to financial activities that have contributed to the realization of a sustainable society (including a wide range of financial activities such as loans as well as investments).

In the “Business Subcategory,” initiatives that have contributed to the realization of a sustainable society through the use of sustainable finance* are invited.

* Sustainability-linked loans, sustainable funds, and other similar financing methods that take sustainability into consideration (including a wide range of financing from VC and other sources).

Initiatives related to human resource development (expansion of the base and improvement of skills) for “providers,” “intermediaries,” and “recipients” of funds in sustainable finance* and their “supporters” are widely solicited. (Initiatives of your own company and those to provide services to other companies are both eligible for the application.)

The submitted solutions will be reviewed from the perspectives of whether they contribute to the realization of a sustainable society by utilizing sustainable finance (including broad-based funding from VC and other sources), whether they are consistent with the initiatives being solicited, and whether they are unique to the initiative and its results.

* A financial methodology that utilizes funds to address global issues such as climate change and other environmental issues, as well as human rights, poverty, and other social issues, in order to transform society into a more sustainable form

At the awards ceremony, a total of about 3 particularly outstanding applicants will be awarded in the Investment Subcategory and the Business Subcategory. Among them, one business that is particularly excellent in its green finance initiatives will be awarded with the “Governor’s Special Prize for Green Finance”. From the Sustainable Finance Human Resource Development Subcategory, about one applicant who is particularly outstanding will be awarded. In addition to these awards, “Special Awards” may be given to other excellent initiatives.

In addition, the following benefits will be granted to those businesses that are selected for the final screening.

Committee Chair

Committee Members

* List from those whose appointment has been confirmed.

To be updated in due course.